Case Study Details

About The Project

SECI Utility-Scale Solar Auctions – Navigating Risks in India’s Solar Bidding Landscape

Project Scope and Context

Between 2019 and 2020, the Solar Energy Corporation of India (SECI) floated numerous utility-scale solar tenders across key states, including Gujarat, Karnataka, and Tamil Nadu. These auctions aimed to support India's ambitious renewable energy goals through competitive tariff discovery and large-scale project deployments.

Tariff Stabilization and Market Trends

-

Auction tariffs stabilized in the INR 2.50–2.87/kWh range, reflecting an era of relative price consolidation after aggressive bidding in earlier years.

-

While the tariffs were favorable for DISCOMs and consumers, developers began facing margin pressures due to increased cost inputs and financial risk exposure.

Challenges Faced by Developers

-

Interest Rate Volatility: Fluctuating financing costs led to uncertainty in cash flows and future project viability.

-

Import Duties: The imposition of Basic Customs Duty (BCD) and constraints from the Approved List of Module Manufacturers (ALMM) inflated module procurement costs, affecting project economics.

-

Delayed Payments: Several state DISCOMs struggled with payment delays, undermining developer confidence and contributing to liquidity stress in the sector.

Impact on Financial Returns

-

Financial modeling under current conditions showed equity Internal Rate of Returns (IRRs) compressing to ~12–13%, down from earlier highs of 16–18%.

-

Reduced IRRs threaten long-term capital flows and dampen enthusiasm among both domestic and global investors.

nstitutional Role and Mitigation Efforts

-

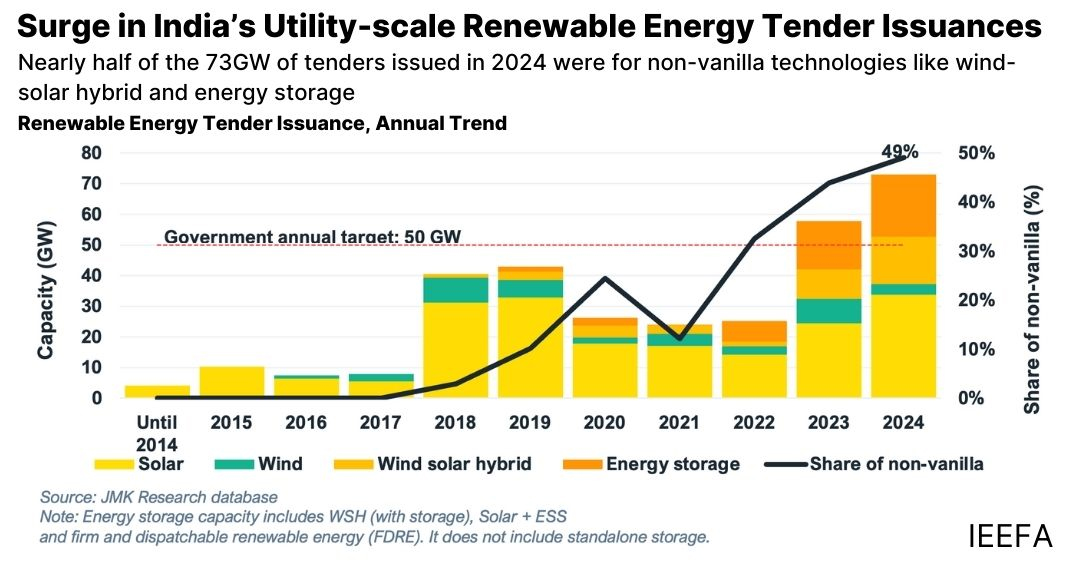

SECI continued efforts to address developer concerns by enhancing payment security mechanisms and diversifying tender formats (e.g., RTC and hybrid projects).

-

Ongoing industry dialogue around bidding reforms, including potential transitions to closed bidding formats, aims to reduce excessive downward tariff pressure.

Strategic Insights

-

The case highlights the importance of a balanced tariff structure, where affordability for DISCOMs doesn’t erode developer viability.

-

Enhanced risk-sharing frameworks and streamlined grid integration are vital to maintain investor momentum in future tenders.