Case Study Details

About The Project

Intrinsic Valuation of Pension Fund Investments Backed by RMBS/ABS-CDOs

Client Profile

One of the largest financial institutions in the United States, with a diversified portfolio of pension fund investments across structured finance products, including RMBS, ABS-CDOs, and home equity loan-backed securities. The client serves sovereign entities and insurance companies, requiring robust credit analytics and valuation support for secondary market transactions.

Project Objective

To deliver bottom-up credit insights and intrinsic valuation for pension fund holdings backed by non-agency RMBS and ABS-CDOs, enabling informed investment decisions in the secondary market. The goal was to assess creditworthiness at the loan level and support pricing strategies for complex structured products.

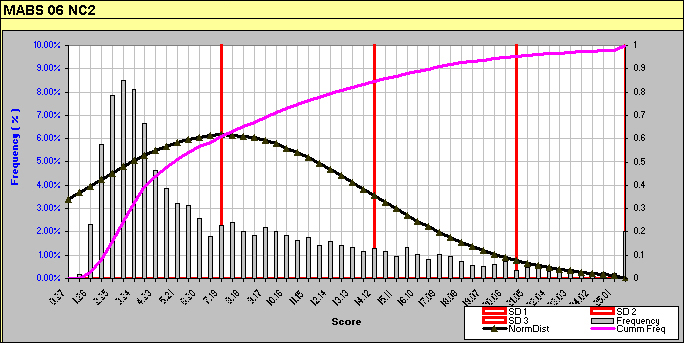

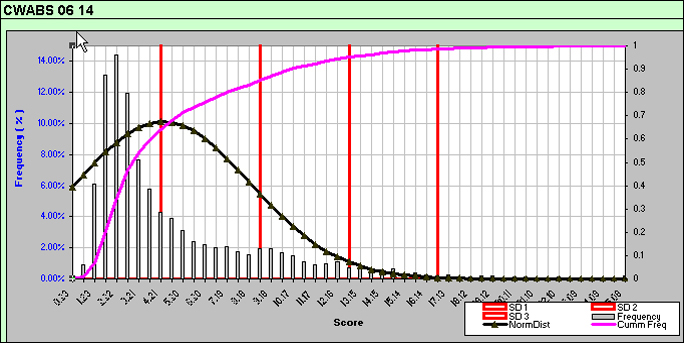

Normal, frequency and cumulative distribution of loan scores with standard deviation multiples.

Our Approach

Loan-Level Mortgage Modeling

-

Developed granular models based on individual loan performance, incorporating borrower behavior, property characteristics, and macroeconomic factors.

-

Simulated default probabilities, prepayment speeds, and loss severities under various economic scenarios.

Credit View Construction

-

Built bottom-up credit views by aggregating loan-level analytics across tranches and deal structures.

-

Integrated economic indicators such as unemployment rates, home price indices, and interest rate curves to stress-test asset performance.

Loan Score-Based Credit Model

-

Designed a proprietary Loan Score framework to rank and segment loans based on risk-adjusted metrics.

-

Enabled intrinsic valuation by mapping loan scores to expected cash flows and credit enhancement levels.

Valuation of Non-Agency Bonds

-

Applied the model to non-agency RMBS and ABS-CDO bonds traded in the secondary market.

-

Delivered pricing insights and relative value analysis for pension fund portfolios, supporting buy/sell decisions and risk management.

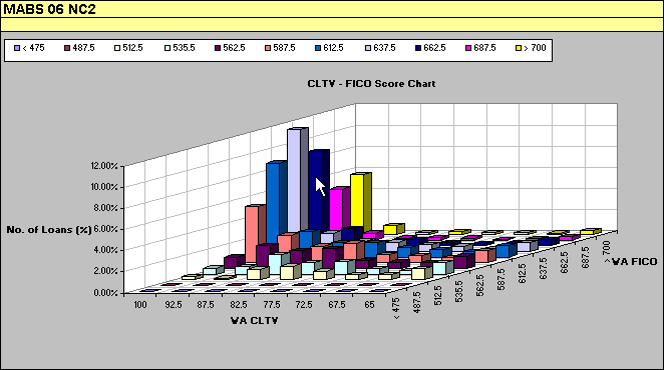

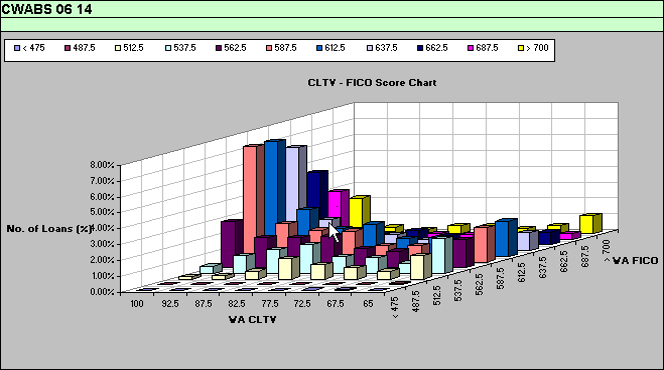

Loans Vs FICO Vs CLTV for the two deals.

Impact & Outcomes

-

Provided the client with high-resolution credit analytics that enhanced transparency and confidence in asset performance.

-

Enabled more accurate pricing and risk-adjusted return assessments for pension fund investments.

-

Strengthened the client’s ability to navigate secondary market complexities and optimize portfolio allocations.